A Look at California’s November Jobs, The Fed’s Interest-Rate Decision, and the State’s Population Growth

- California added 30,700 jobs in November, with the unemployment rate holding at a record-low 4.1 percent according to the latest numbers from the state Employment Development Department. October’s job gains were revised up to 36,800.

- Over the last year, a 1.8 percent increase in employment led to 299,800 new jobs. The state has created 3,078,100 jobs since February 2010.

- Nine out of 11 industries added jobs over the last month, with the largest increase in leisure and hospitality (up by 12,400 jobs), professional and business services (up by 7,600 jobs), and construction and education and health services (both up by 3,300 jobs).

- Over the year, the largest job gains were in the professional and business services sector (up by 91,100 positions for a 3.5 percent increase), education and health services (up by 63,300 jobs for a 2.4 percent increase), and leisure and hospitality (up by 50,600 jobs for a 2.6 percent increase).

- Typical for the season, retail trade led monthly employment gains across most metropolitan areas.

- Job losses over the month were dominated by the information sector, which shed 4,500 positions but is still up over the year. Only other services and mining and logging posted annual losses of 1,300 and 400 jobs respectively.

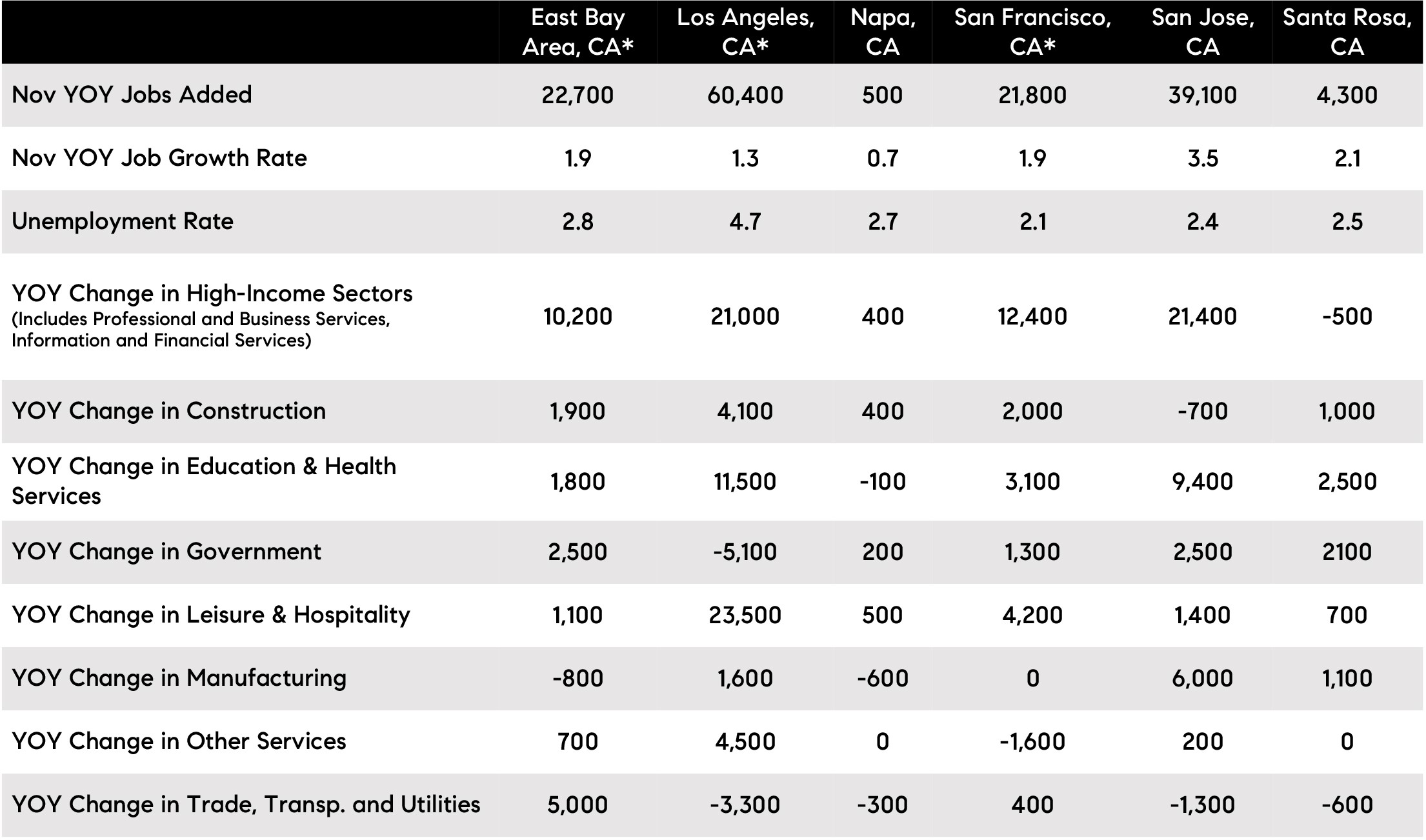

- Table 1 summarizes November year-over-year employment changes by California metropolitan area. San Jose (which includes Santa Clara and San Benito counties) continues to lead the job gains, with a 3.5 percent year-over-year increase in employment, while other regions mostly hover around 2 percent growth or less.

Table 1: November year-over-year employment changes by California metro area

* The East Bay Area includes Alameda and Contra Costa counties

* Los Angeles includes Los Angeles County

* San Francisco incudes San Francisco, Marin, and San Mateo counties

About The Federal Reserve’s Decision to Raise Interest Rates

- As shown above, employment remains strong, and confidence in the labor market is largely why the Federal Open Market Committee raised its target for the funds rate by 25 basis points on Wednesday.

- The FOMC has now hiked rates by 225 basis points over the past three years, 100 of which occurred in 2018.

- While analysts have generally expected this decision, recent market volatility and some softer economic data led markets to expect that the FOMC would dial back its rate-hike path. However, in its statement, The Fed did signal that it will remain flexible on how fast rates increase but not whether they increase. The Fed also maintained its reliance on economic data — which is solid — and not on financial markets, which are rapidly turning pessimistic and sending strong real-time feedback by the stock sell-off.

- Financial markets may not believe that economic growth will continue to be as strong as The Fed may believe. Most of the growth has been in the energy and technology sectors, neither of which are slowing. The energy sector is weighed down by slower global growth and lower oil prices, while technology has come under increased government scrutiny over privacy concerns and antitrust issues.

- Also, The Fed may have underestimated the impact over its statement about the shrinking balance sheet remaining on autopilot, which may have further concerned investors who are looking for more signs of the agency’s sensitivity toward markets.

- Nevertheless, much of the emotional aspect of the current financial market volatility can be explained using John Maynard Keynes’ term “animal spirits,” which he defined as “a spontaneous urge to action rather than inaction and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.”

About California’s Population Growth

- According to a separate report published by the U.S. Census Bureau this week, California added 157,696 residents between July 1, 2017 and July 1, 2018, and the state is now home to 39,557,045 people.

- The state’s population gain was due to births and international migration.

- Domestic outflow added up to 156,068 residents who left the state, which was the second largest behind New York and accounts for 0.4 percent of California’s total population.

- Still, California ranks 11th in the U.S. for out-migration, with Alaska, New York, Illinois, and Hawaii seeing double the share of people leaving the state.

Selma Hepp is Compass’ Chief Economist and Vice President of Business Intelligence. Her previous positions include Chief Economist at Trulia, senior economist for the California Association of Realtors, and economist and manager of public policy and homeownership at the National Association of Realtors. She holds a Master of Arts in Economics from the State University of New York (SUNY), Buffalo, and a Ph.D. in Urban and Regional Planning and Design from the University of Maryland.

(Promotional photo: iStock/PeopleImages)

TEAM WAKELIN

TEAM WAKELIN