California Home Sellers Want 2017 Prices, but Buyers Are Patient in 2019

.

California housing markets are at a critical juncture at the beginning of 2019. After experiencing the tightest market conditions seen over the past three years in the first half of 2018, the number of homes sold in the Bay Area and Los Angeles has continuously declined since mid-2018. In January 2019, the year-over-year decrease in home sales continued at double-digit-percent rates, with the three-month average decline in the Bay Area at 16 percent and Los Angeles down by 18 percent. In other words, over the last three months, about 1,100 fewer units sold on average per month than last year in Los Angeles, while the Bay Area averaged about 700 fewer sales.

The decline in sales activity comes amidst sustained economic strength, improved inventory levels, and more recently, stable mortgage rates. Nevertheless, it is clear that financial-market volatility, trade-war concerns, last year’s mortgage-rate jump, and the government shutdown have weighed on consumer sentiment and housing decisions.

Sellers have noticed the cooling buyer demand, which has led them to change their pricing expectations. But even with more price reductions, added inventory, and lower mortgage rates, buyers are not as confident as they were last spring.

So how will California housing markets fare in the spring of 2019?

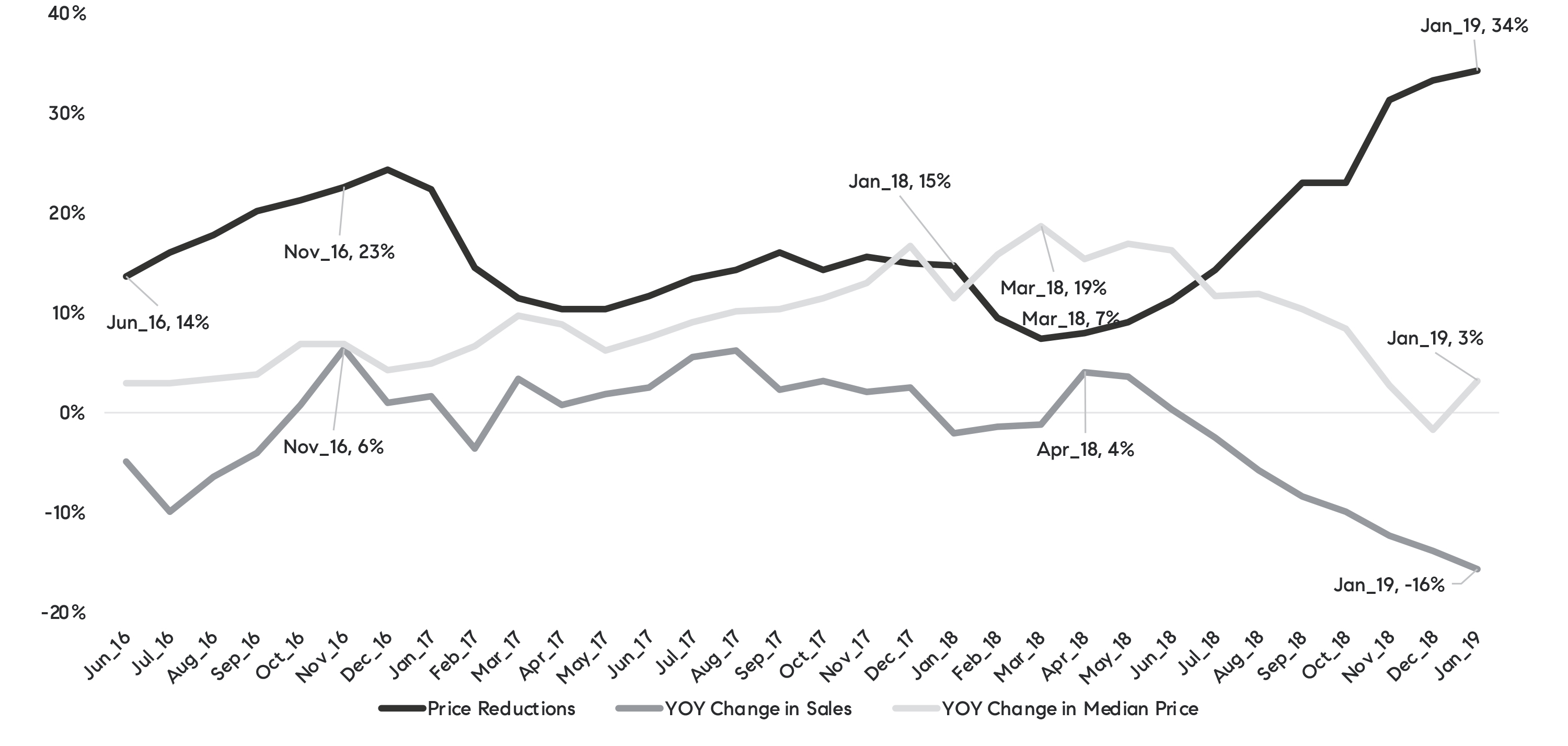

The Bay Area: To demonstrate the divide in seller and buyer behavior, Figure 1 illustrates Bay Area market dynamics over the last three years.

Figure 1: Home price reductions, sales changes, and median price changes in the Bay Area, June 2016 through January 2019

Source: Terradatum, Inc. from data provided by local MLSes, Feb. 5, 2019

The black line in the chart above illustrates seller behavior by measuring the share of homes that sold for less than asking price. By contrast, the dark gray line illustrates buyer behavior by tracking the three-month moving year-over-year change in total units sold in the Bay Area. Lastly, the light gray line tracks year-over-year changes in the region’s median home price.

The percentage of homes that sold at reduced prices increased from 14 percent in June 2016 to 23 percent in November 2016. Buyer demand followed this trend, and the number of units sold increased by 6 percent from the previous year.

Coming into 2018, the Bay Area’s year-over-year median home price growth accelerated notably, reaching 19 percent in March. At the same time, price reductions fell to some of the lowest levels in three years, with only 7 percent of homes selling at a discount. Buyers were at their competitive peak in the early spring of 2018, pushing sales up by 4 percent year over year. As the chart shows, it appears that the spring of 2018 was the tightest housing market that the Bay Area has seen in the last three years.

The distinct separation in seller and buyer behavior began in May 2018, when buyers pulled away. This led to a consistent decline in units sold through the end of January 2019, from a 4 percent increase in April 2018 to a 16 percent decrease in January 2019. And while price reductions follow seasonal patterns and generally peak in December or January, the decline in buyer demand led to a notably larger increase in price reductions than seen in prior years. Price cuts nearly quintupled, from 7 percent in March 2018 to 34 percent in January 2019. As a result of more homes selling at reduced prices, Bay Area communities saw year-over-year median home price growth of 3 percent in January 2019, the lowest rate observed in at least the last three years.

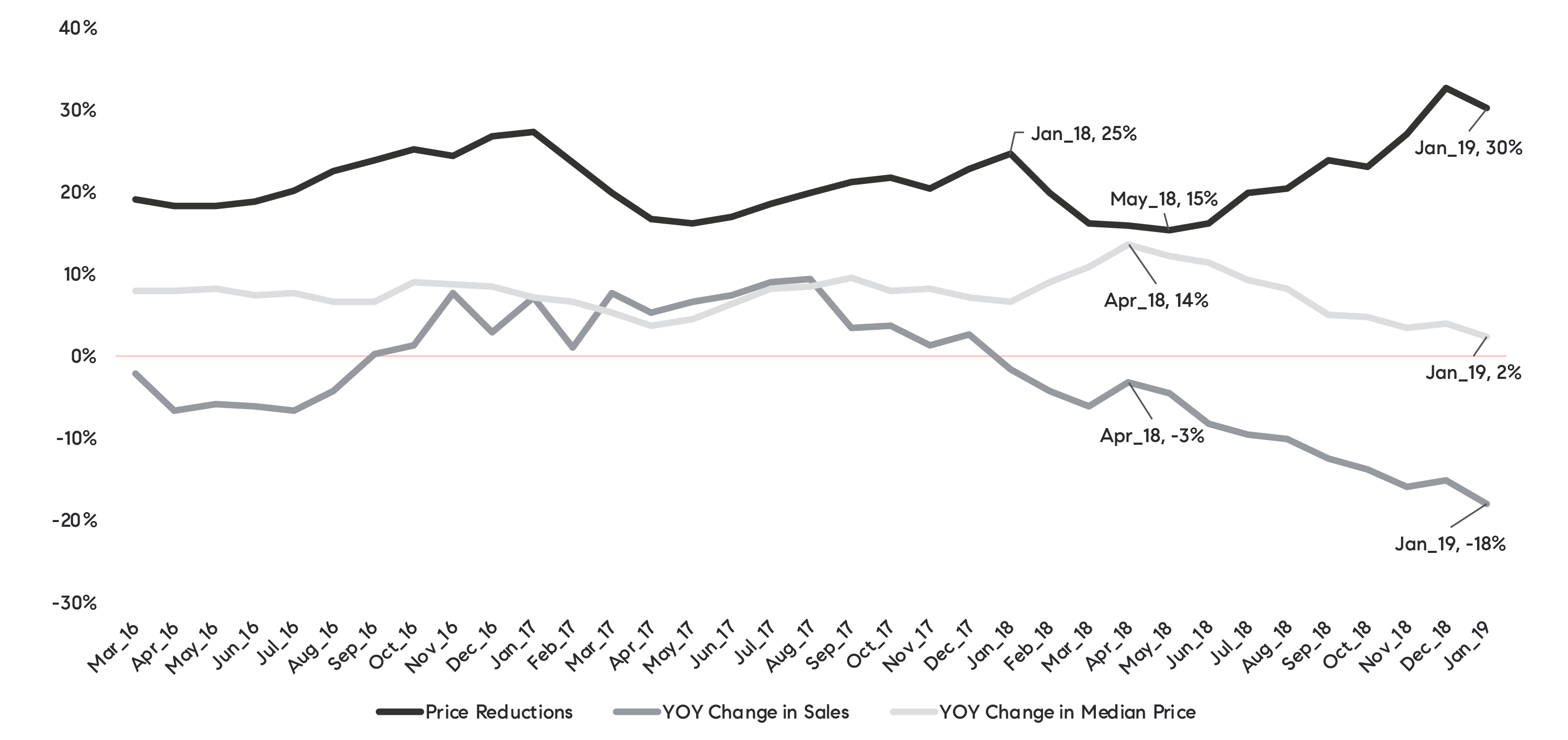

Los Angeles: Figure 2 illustrates the same set of market indicators as used in Figure 1 for the greater Los Angeles area. Clearly, market dynamics follow very similar trends as seen in the Bay Area. After reaching the tightest point in the spring of 2018 — when price appreciation accelerated to 14 percent and reductions bottomed out at 15 percent — the market took a turn, as both median price growth and sales dropped significantly. However, unlike in the Bay Area, Los Angeles didn’t start to post inventory increases until the fourth quarter of 2018, leading to an earlier annual decline in home sales than was observed in the Bay Area.

Sellers felt the buyer retreat in the second half of 2018, which led to the highest increase in price reductions seen in at least the last three years, peaking at 34 percent in December 2018 before falling to 30 percent in January.

Figure 2: Home price reductions, sales changes, and median price changes in greater Los Angeles, March 2016 through January 2019

Source: Terradatum, Inc. from data provided by local MLSes, Feb. 5, 2019

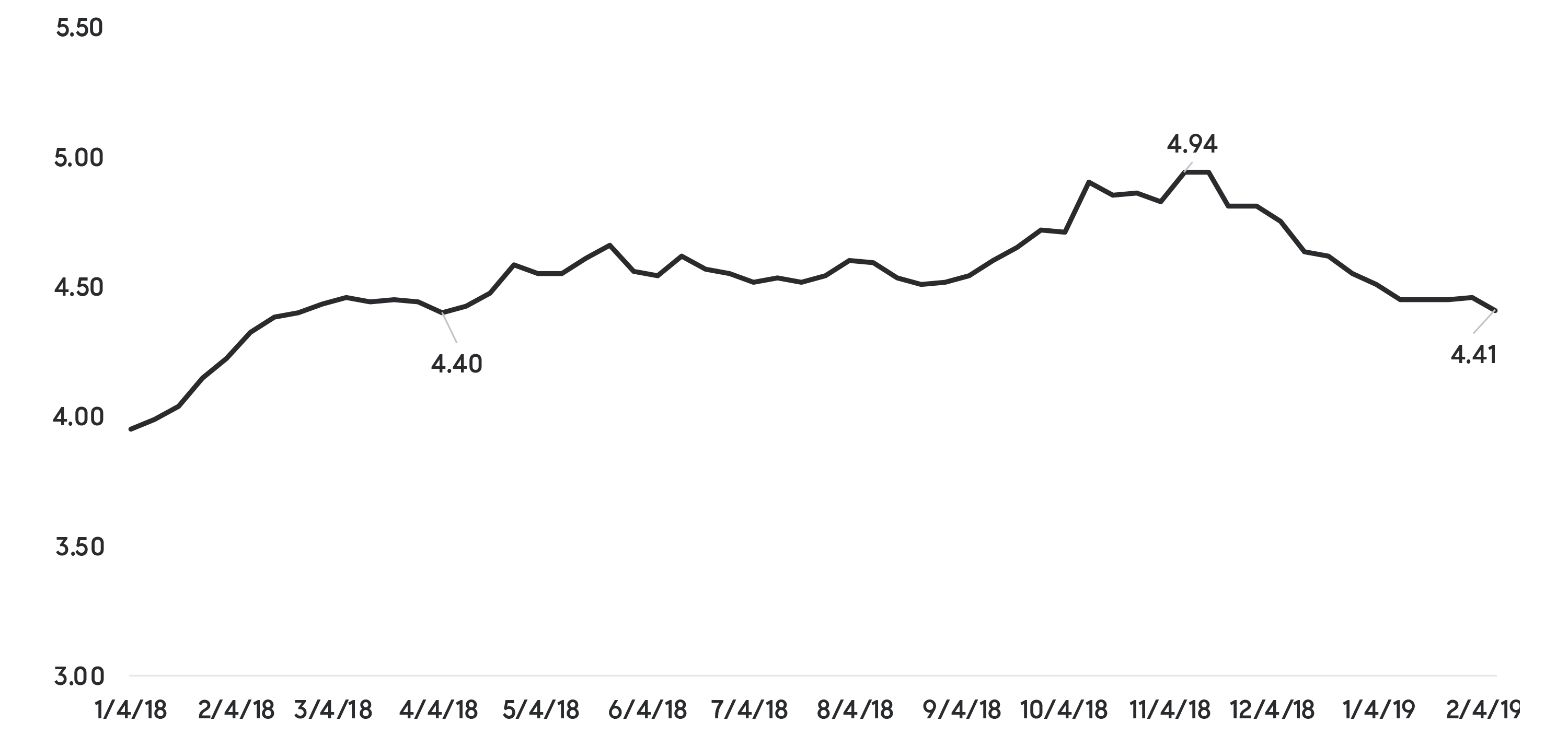

To bring buyers back to the market in both the Bay Area and Los Angeles, median home prices will likely need to return to levels seen at the beginning of the 2018 spring homebuying season. With price reductions leading to a January slowdown in appreciation of 2 percent to 3 percent, and mortgage rates also returning to early 2018 levels (see Figure 3), buyers now enjoy more favorable conditions than they did in the second half of 2018. However, with total 2018 median price growth of 12 percent compared with 2017 in the Bay Area and 8 percent in Los Angeles, many buyers have exited the market and are unwilling to purchase homes until they see larger price reductions and cooling home price growth.

For sellers, hanging on to 2017 pricing expectations will likely result in multiple reductions and increased time on the market, which itself may lead to sales prices that are below actual fair market value. In high-end markets, where homebuying decisions are more subjective than those based on affordability, buyers are focused on fully renovated homes that are priced at market value, as opposed to buying in anticipation of further price gains to rationalize their purchases.

In conclusion, while a dismal end to 2018 branded California housing markets with a big question mark in 2019, many conditions have shifted in favor of buyers: lower mortgage rates, slower price growth, more inventory, and less competition. If sellers rethink their expectations, the spring homebuying season could start strong.

Figure 3: U.S. 30-year fixed-rate mortgages, January 2018 through February 2019

Selma Hepp is Compass’ Chief Economist and Vice President of Business Intelligence. Her previous positions include Chief Economist at Trulia, senior economist for the California Association of Realtors, and economist and manager of public policy and homeownership at the National Association of Realtors. She holds a Master of Arts in Economics from the State University of New York (SUNY), Buffalo, and a Ph.D. in Urban and Regional Planning and Design from the University of Maryland.

(Promotional photo: iStock/Rawpixel)

TEAM WAKELIN

TEAM WAKELIN