Jobs Report suggests continued strength in employment, alleviating fears of looming recession

Today’s much anticipated national employment report from the U.S. Bureau of Labor Statistics provided further evidence of continued solid economic growth. There were 196,000 jobs added in March, after a wild swing between January’s 312,000 additions and February’s 33,000 additions. The three-month average is now 180,000 in the first quarter, which was above economists’ expectations and still robust considering the low unemployment rate of 3.8 percent. The unemployment rate remained unchanged in March.

It’s important to note, in a trend since 2010, generally one of the first quarter months has seen distortions in seasonal estimations of payroll data. This has been attributed to variation in the timing of winter storms and holidays, but also the 2.3 million drop in payrolls in Q1-2009 — the largest drop in a single quarter since 1945 — may have also disrupted the seasonal adjustment process for the first quarter jobs data.

The economy has added jobs for 102 straight months, the longest continuous stretch in recorded history. Going forward into the year, economists expect the hiring to continue, albeit at a slower pace as a tighter labor market makes it more difficult for employers to find available workers. According to NABE’s Business Conditions Survey, about 53 percent of businesses are reporting skilled labor shortage, with the rate on a continual increase since the economic expansion began. Also, the fueling impact of tax cuts has began to fade and will contribute progressively less to job growth.

Furthermore, the labor force participation rate fell slightly to 63.0 percent, from 63.2 percent the month before, which means roughly 224,000 fewer available workers — most likely due to retiring Baby Boomers.

While health care and social assistance, professional and business services, and leisure and hospitality gained the largest number of jobs in March, manufacturing posted a decline of 6,000 jobs with most all of them in the motor vehicle and parts sectors — a sign of slower economy abroad and trade headwinds. Retail trade and temporary help services also posted declines, possibly a reflection of weakened consumer demand seen in the retail sales report issued earlier in the week.

Wage growth rose only slightly, 0.1 percent, rounding the annual growth to 3.2 percent in March. Still, current wage growth, which notably picked up pace in 2018, is now the highest growth rate since 2009. Also, wage growth is currently strongest in low-wage industries, with the pace of nonsupervisory employees outpacing wages in professional and business services since October 2018.

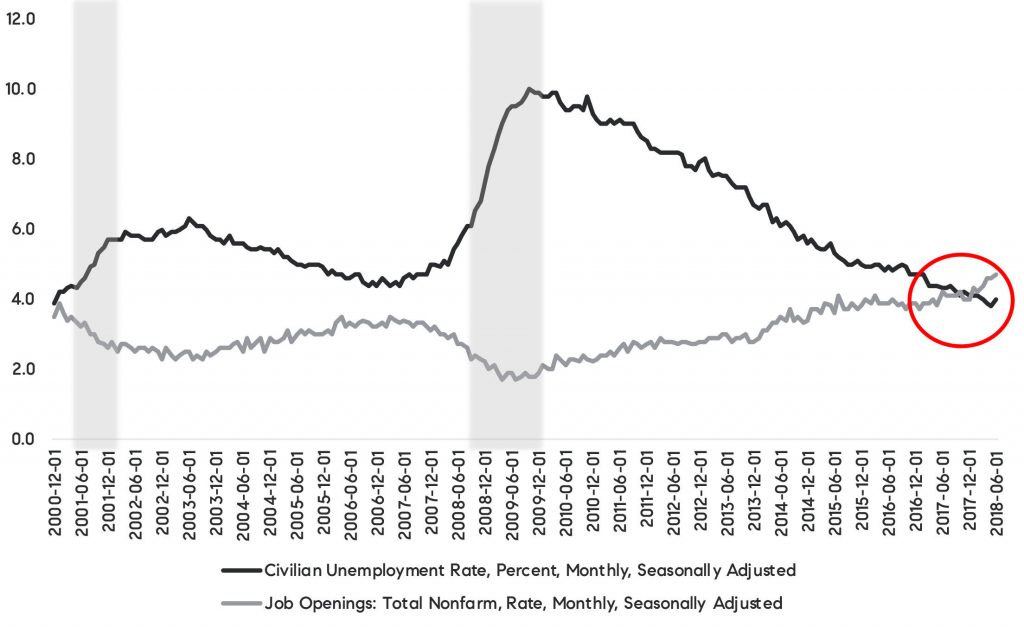

Today’s report should be a booster to investors and those dreadfully looking for signs of recession. Another positive sign, very different from the previous two pre-recession periods, is the increasing job openings trend (see Figure 1). According to the U.S. Bureau of Labor Statistics Job Opening Labor Turnover Survey released earlier this month, job openings increased again from the month before, reaching 7.58 million at the end of January. Job opening rate also increased slightly to 4.8 percent, up from 4.7 percent the month before.

Lastly, according to today’s CompTIA report, the U.S. tech sector added 16,000 new jobs in March, its strongest month for hiring so far this year. The unemployment rate for IT occupations was 1.9 percent in March. Looking ahead, employers increased the number of job postings for core IT positions by an estimated 62,433 in March over February, with software and application developers in highest demand.

Figure 1

Taken together, the series of job releases suggests continued strength in employment and an optimistic outlook among U.S. organizations, which should help alleviate fears of looming recession and the negative rhetoric loop which can be a dangerous self-fulfilling prophesy. Still, Federal Reserve is expected to remain “patient” and possibly restrain from any further rate increases in 2018.

TEAM WAKELIN

TEAM WAKELIN